Shortcut to Download Your SA302 from HMRC

From September 2017 HMRC will no longer be providing paper versions of the SA302 tax calculations to agents but instead will enable people to print them Online via the Government Gateway login.The problem is – The Online version that you can print off makes no mention of SA302 anywhere, even when you find the relevant page on the HMRC website it isn’t clear that you are on the correct page which can often lead to confusion.

To help you overcome this problem and find the correct document we have created this handy little tool which takes you direct to the relevant page on the HMRC website.

Simply enter your UTR and the year of the SA302 you require and you will be taken straight to the rellevant section on the HMRC website – Although there is mo mention of SA302 on the page the version you print when using the bottom right link of the tax calculation is the version accepted by most Mortgage Providers (see image 1.1).

Note: Sign in to your Government Gateway account via this link to Find Your UTR

(displayed top right of page after signing in)

Download your SA302 from HMRC

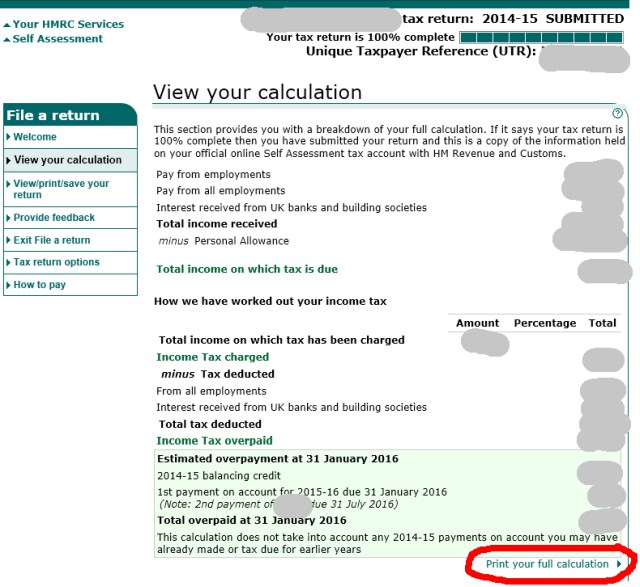

Example of Digital SA302 Tax Calculation

The following image shows an example of a digital SA302 Tax Calculation with the link highlighted in red being the one you should click to print your digital SA302

[image 1.1]

How to Find Your UTR (Unique Tax Rererence)

Note: You can find your UTR number on numerous documents provided by HMRC or by signing in to your Government Gateway account via this link – Find your UTR

Your UTR is displayed top right of the page after you log in (as shown below)

[image 1.2]

Download your Tax year overview from HMRC

We also provide a similar tool that takes you direct to your “Tax year overview” page which is generally also required by mortgage providers.